Want a more visual way to maintain your timeline?

This chapter lays out a timeline workflow that will dramatically reduce financial admin and budgeting stress. You'll always know where you're at financially in a matter of seconds. Sound a bit far-fetched? It's been working brilliantly for me for years. This system will deal with all of your personal finances in a typical month. You could easily build a separate business implementation with the dynamics I'm going to show you… but for the time being, let's delve into the area of personal finances.

As simple as budgeting can get

You and I make and spend money on a timeline.

We have bills and expenses on specific days of the month. We also get paid on a timeline – whether a once-a-month salary, or at variable times. It's truly a never-ending story, worthy of a timeline strategy.

The system I'm about to walk you through is stupid simple, but it will do wonders for you admin-wise. It will easily allow you to see what sort of financial situation you're in at a glance… and enable you to make decisions and pivot – if necessary. The information is all there, on demand.

Instead of budgeting becoming an entire project in itself, that you need to dedicate a significant amount of time to, the timeline makes it into a rhythm. Small micro actions on your part throughout the month will take budgeting from being a mission, to being something as quick and easy as a game of rock, paper, scissors.

Time is on my side. Yes it is.

Just as everything date sensitive has a place on the timeline, so do our finances. Each item has a day and an amount. Whatever it is, push it into your timeline. A couple of examples:

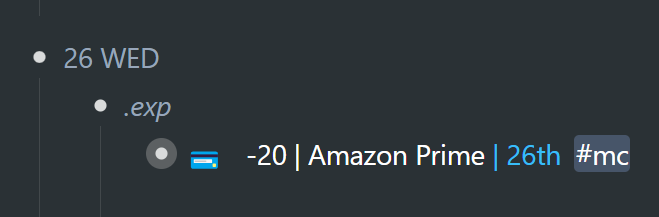

On the 26th of each month, my credit card gets charged 20 Brazilian Reals for Amazon Prime. Notice how I include a minus before the 20. You'll see why in a bit. The tag indicates that this item is on my credit card (and not my wife's). It also has a credit card emoji, indicating that it's a credit card expense:

Even though I'm charged automatically every month for this specific subscription (and therefore don't need to take any action), it is worth having on my timeline for the following 2 reasons:

1. It is a part of my monthly expenses, and having it on my timeline allows me to make accurate calculations with the help of the Adding Machine tool, which I'll illustrate shortly.

2. It's a visual reminder as to whether I'm going to continue with this subscription.

My job at the WorkFlowy help desk highlights the fact that so many people forget they have ongoing subscriptions… they'll keep getting charged until they notice the monthly deductions on their credit card statement. I don't have such surprises, because I have everything on my timeline, to consider.

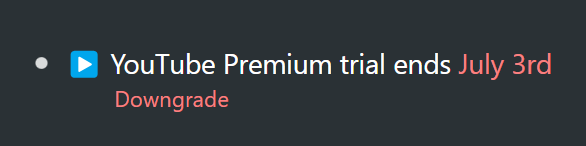

On your timeline, you should also have services with trial subscriptions that will auto-charge your credit card once the trial period is over. This gives you a chance to downgrade before there's a charge – if you're not interested.

I figured I could live without YouTube Premium. I came across this item on my timeline on July 2nd, a day before the end of the trial… and made the decision to cancel:

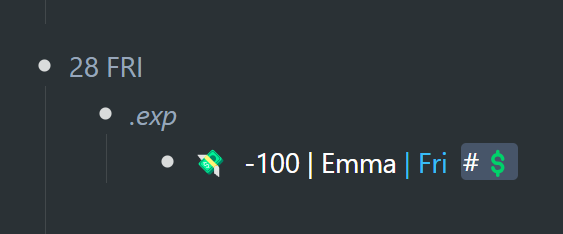

Every Friday I give my daughter an allowance for eating out with her friends over the weekend. Notice that there's a "💲" tag. We'll get to that.

Every 4th of the month I have to pay rent and condominium fees. And so it goes… each expense has a date and an amount. It also has an emoji that identifies it as an expense.

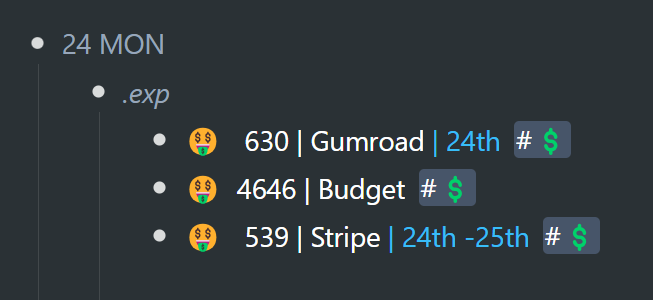

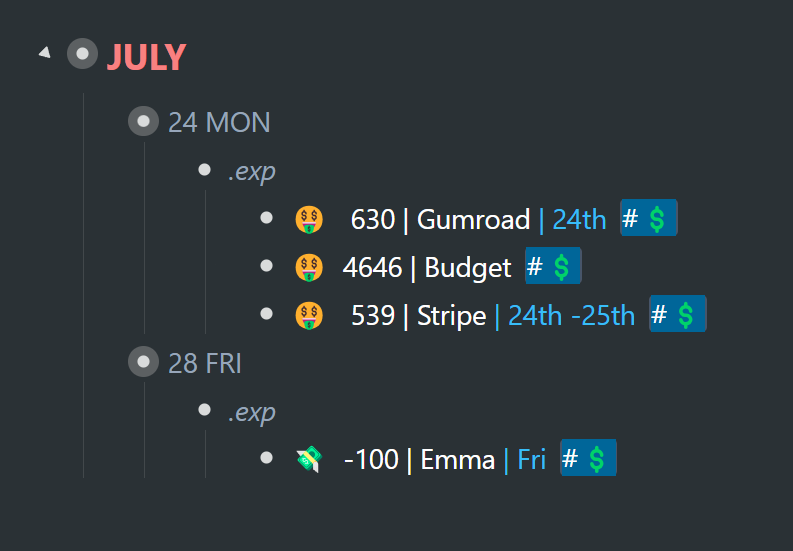

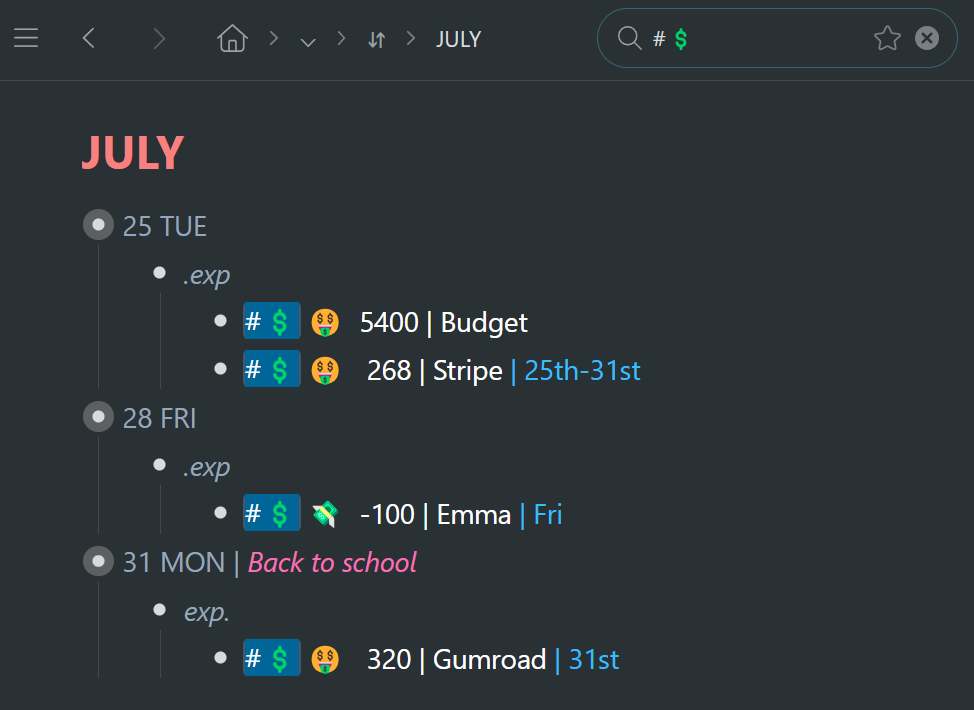

On the 24th (which happens to be tomorrow at the time of writing), there are 3 items that have a positive balance (they don't have a minus sign). The "Budget" item is how much money I have in my checking account at the moment. The "Stripe" item is how much money is coming in between the 24th-25th from Stripe… and, likewise, there's incoming money that I should expect tomorrow from Gumroad, a sales platform I use. This bundle of items shows money available and also incoming funds on specific future days. They also have an emoji face with dollar eyes. This shows income or liquid cash.

Many such items live and repeat on my timeline. It's a one-time setup for each of these items. The only admin is moving each item to the next logical date once the current iteration has expired – as with all other items on the timeline

So basically, these items can be seen as reminders or tasks. This in itself is helpful enough… but it's only the beginning.

Just having these items on my timeline automatically opens up several other dynamics… which is where it starts getting powerful.

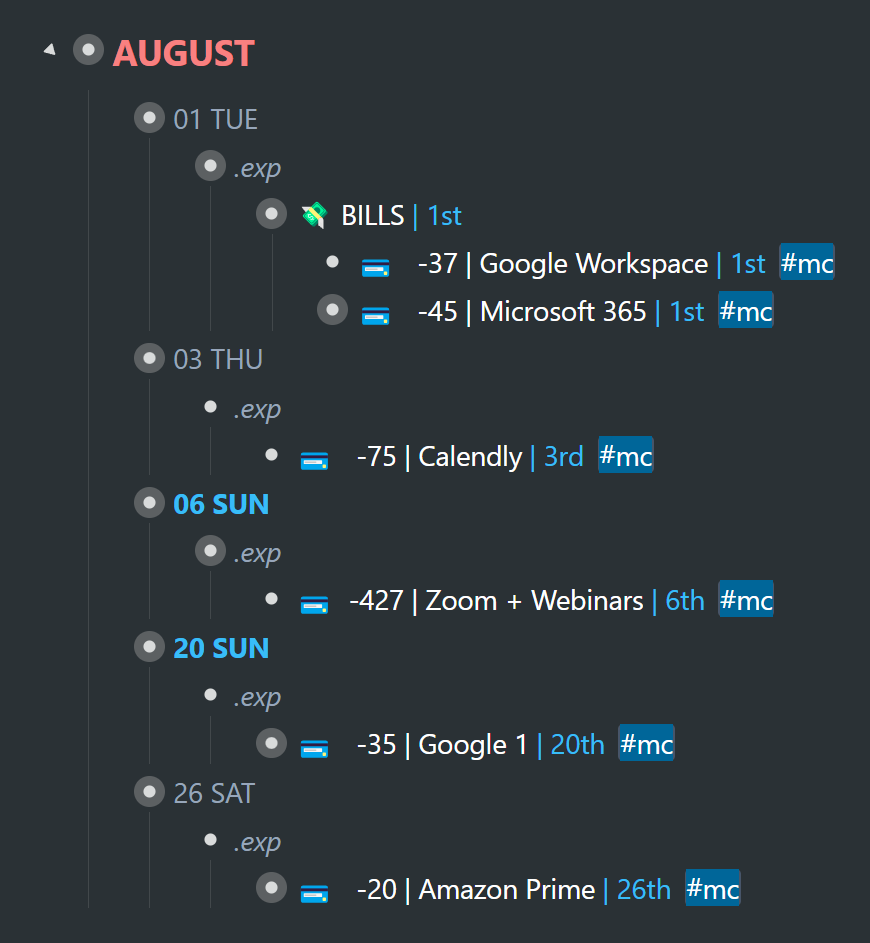

An expense category

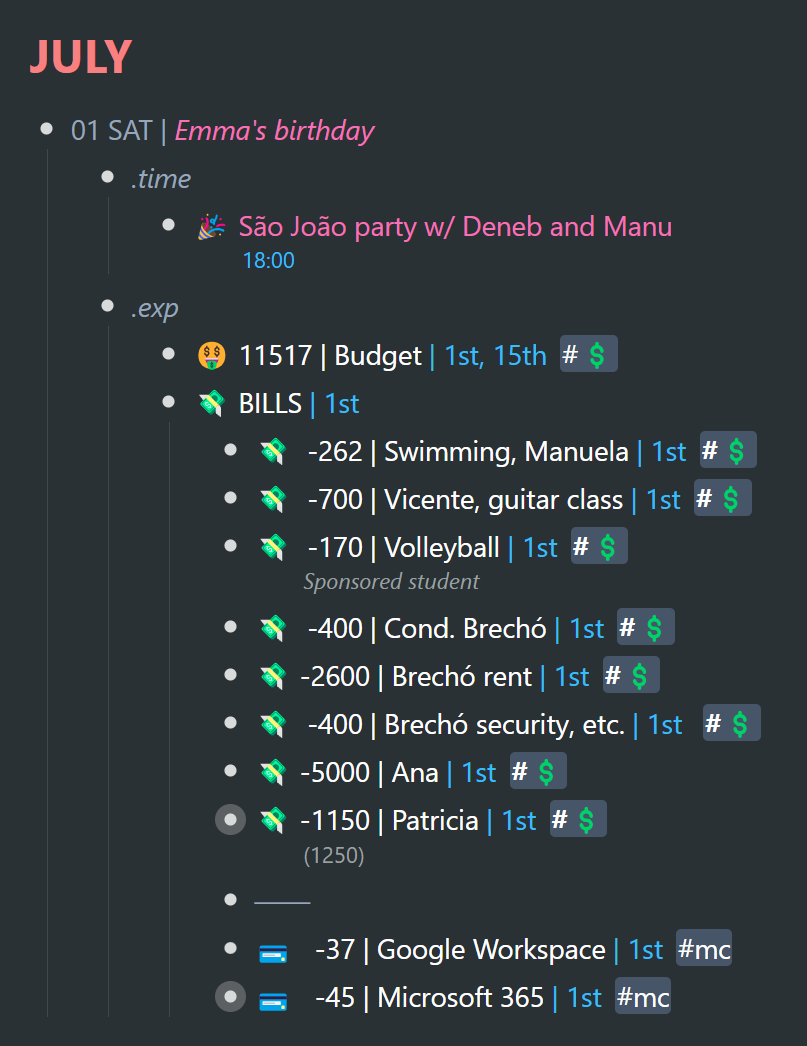

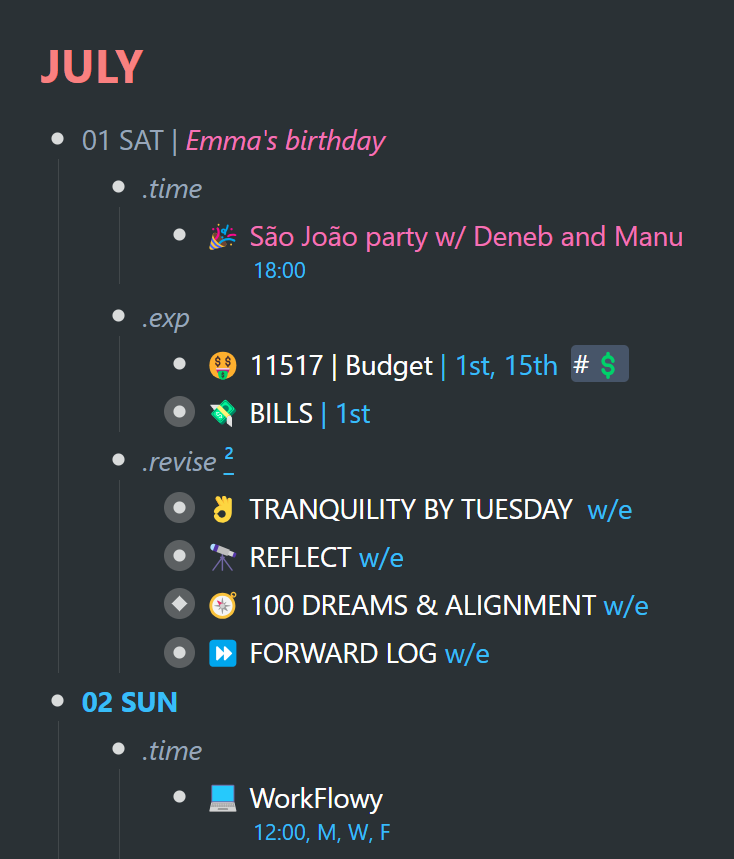

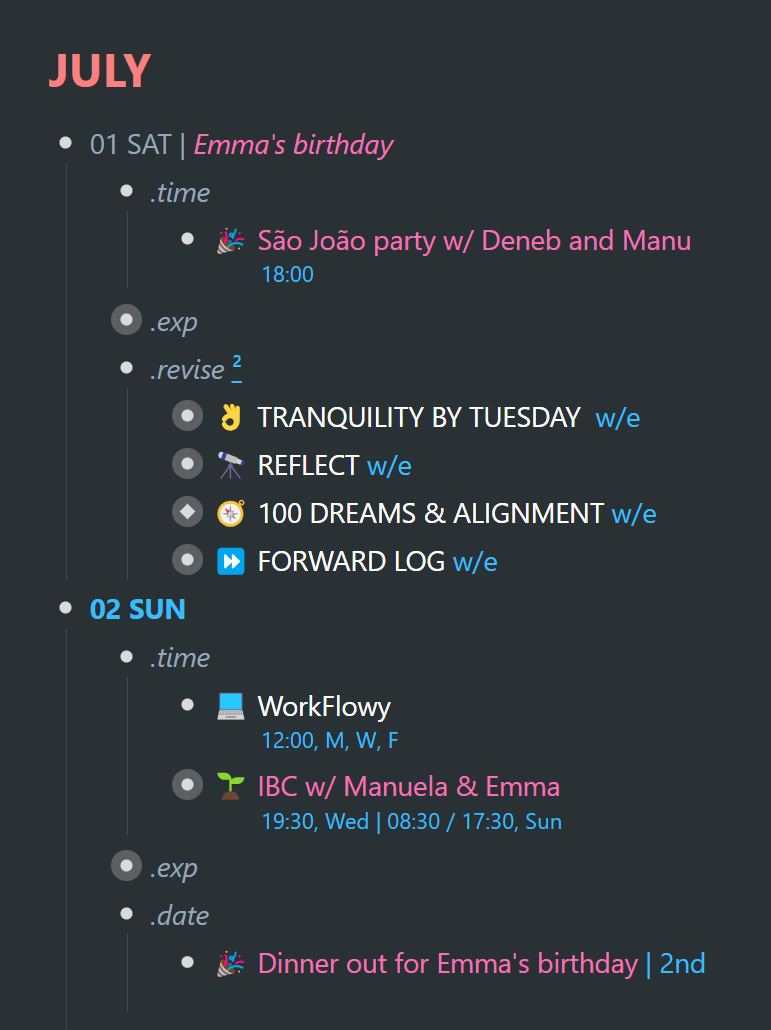

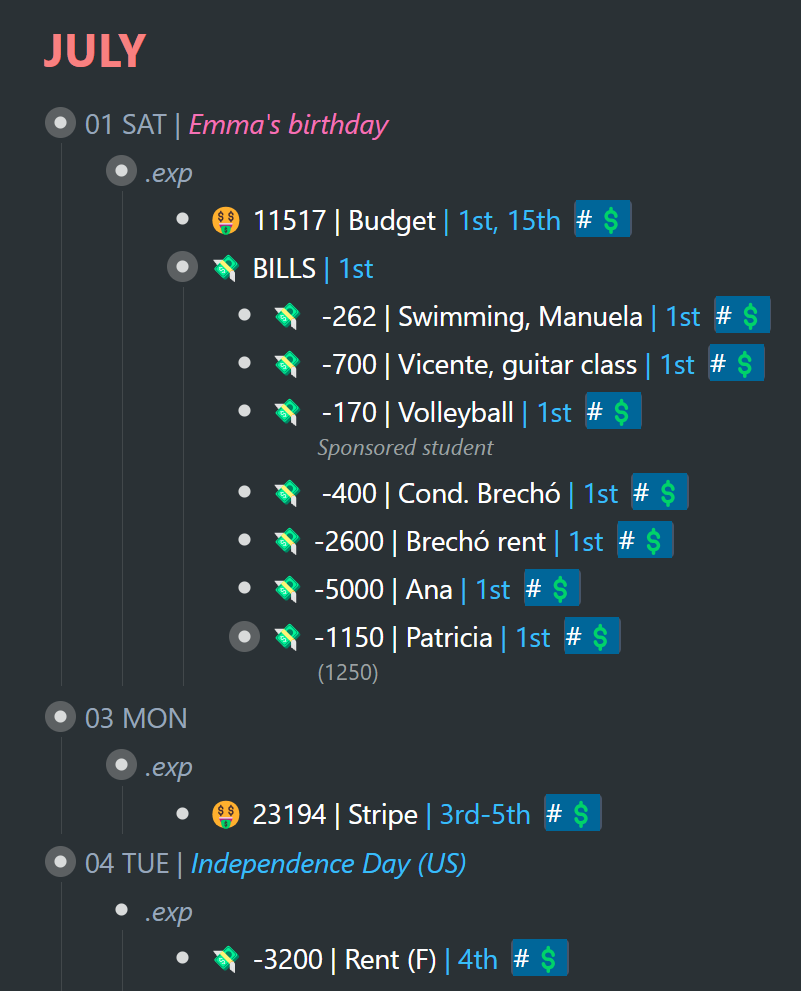

Wherever finance-related items occur on my timeline, I've slotted them into their very own category, under each calendar day. On July 1st, you will see a couple of categories, including an ".exp" (expenses) category, but which also includes any incoming finances. More bills than usual are paid on the first day of the month. No surprise here. I like to have an additional "Bills" outline just for the first of the month, because there are a handful of them.

… but I just keep the "BILLS" outline collapsed. Phew!

Most often, I just keep all the ".exp" categories collapsed. Even better. Less clutter visually on my timeline:

The ".exp" category serves 2 purposes:

1. As we've seen above, it helps to visually separate and/ or declutter what one sees on their timeline.

2. There's a filtering trick with all categories I'll show you a little later ».

The Adding Machine

Now, the part about budgeting…

I was sure to make several screenshots and GIFs at the beginning of the month I find myself in at the time of writing, to better illustrate a few dynamics.

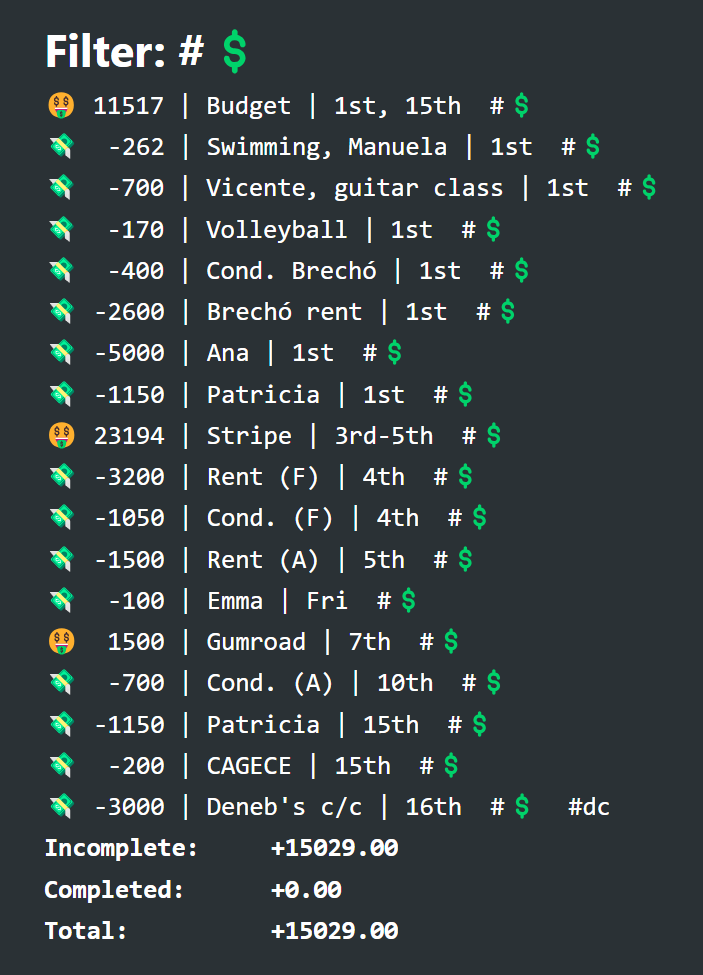

All expense and income items have a "💲" tag. In the GIF below, I click on one of those tags to filter for all of these items…

Once I've filtered for all expenses, I can go ahead and calculate my current budget with the snap of a finger using the Adding Machine tool…

A few years ago I created a screencast on the WFx extension PowerPack script called the "Adding Machine". Click here » to go to the WFx extension YouTube playlist… and scroll down to the Adding machine video. Here's how I use the Adding Machine to get a running total of all income and expenses as often as I need:

1. Zoom into the current month

2. Filter for my "💲" tags…

3. … and then I activate the Adding Machine script via the WFx extension:

It gives me a running total of all positive and negative items (income and expenses) filtered for in a popup dialog. The presales for this book you're reading went nicely (total in Brazilian Reals), and as a result I have resources destined for purposes other than my basic monthly expenses.

What you can do with this list of income and expense items, is run through it and see if at any point during the month you'll go into the red. That sometimes happens, even if the running total is a positive number. You can then decide to prioritize some expenses over others until such time as more income is available. You can see the date(s) at which additional funds will come in and even things out.

Fast forward

At the time of writing, it's July 23rd. Here are the remaining budgetary items on my timeline for the rest of this month:

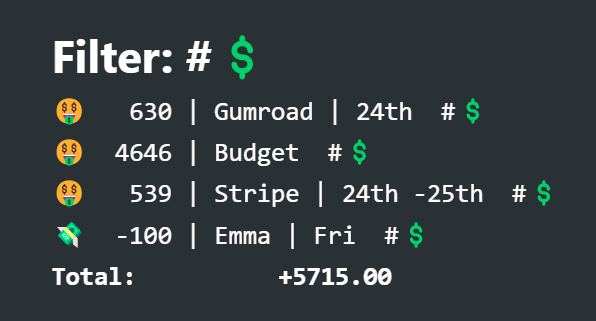

… and here is the Adding Machine running total:

As you progress through any month, your list of expenses gets shorter and shorter… because you push them to the next month once paid.

Here's the workflow again:

1. Zoom into the current month in your calendar

2. Filter for all remaining expenses by clicking on their specific tag

3. Activate the WFx Adding Machine script

Nothing more. Nothing less.

The only maintenance throughout the month:

1. As mentioned previously, when certain expenses are paid for, you push those expenses to the same date the following month. This is done one micro action at a time, just as with everything else on the timeline.

2. You update the item that shows your bank balance whenever you want to calculate your budget

3. You include additional incoming funds on your timeline at the date they will land in your bank account.

That's all there is to it.

This is an incredibly quick and hassle-free way to see the state of your finances as your month wears on. And since I don't have an unlimited amount of cash in the bank, this strategy has been an essential part of my workflow. I don't need to calculate anything. The Adding Machine, in tandem with my expenses and income plotted on my timeline is all I need.

There are months where I have to figure out how to make what I've got stretch. There's a good chance you and I are in the same boat. In order to do so, I've had to get a clear and accurate picture of the state of my finances according to a timeline. When you see your finances according to time, you are better able to juggle and manage those finances at crucial points where there's a breakdown and you can see yourself heading into the red.

When things are a little tight, you'll have to hold off on spending. You may have to push a planned purchase ahead on your timeline. Perhaps a month or two. It's just a matter of time.

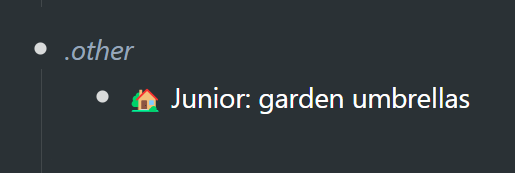

Here's an item on my timeline I decided to hold off on until next month:

We have 4 rather large garden umbrellas I'd like to refurbish. But it's going to have to wait until I get through the first half of August to see if it's possible. Once again, it's easier to make such decisions when you have the tools to quickly see your budget in real time. No guesswork involved. This reduces a lot of anxiety – even if you're not having a good month. If things are not looking good, it's important to know the degree of "not good". It's always better to know. It's uncertainty that brings about more stress than necessary.

Credit card expenses

There are multiple credit card expenses… but there's one payment date for all credit card expenses.

Here are the items on my credit card:

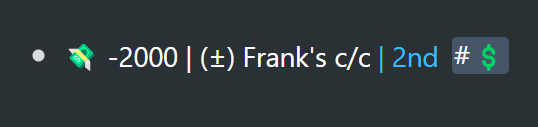

But here's the actual date that I pay for everything (the 2nd of every month):

You can filter for all credit card subscriptions and then use the adding machine to give you a total – which you'll then use as part of the amount that goes into your one monthly bill.

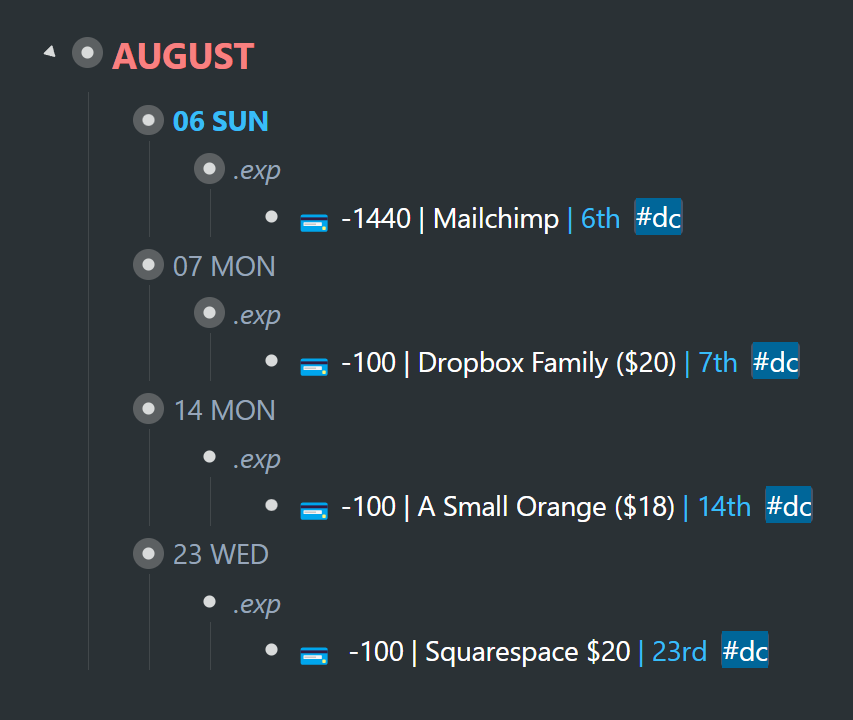

For reasons you can probably guess, my credit card limit was reduced quite dramatically. So for the time being, I've got several of my internet subscriptions on my wife's credit card:

And her credit card is paid every 16th of the month. So I transfer payment to her bank account for the above subscriptions and a few other purchases:

This is simply to point out:

1. Finances can get a little tricky. But my system helps clearly delineate what is what, and makes things a heck of a lot more manageable.

2. The above two examples related to credit card expenses have the following tagging rationale:i. I don't tag individual credit card expenses (with my "💲" tag ) for calculating a rolling budget with the Adding machine. I just tag them to filter for all individual credit card subscriptions, if I'm ever curious.ii. I tag only the actual bill on a specific day of the month with my budgetary tag – for both mine and my wife's credit cards. That way these monthly expenses are part of the Adding Machine calculation.

An afterthought

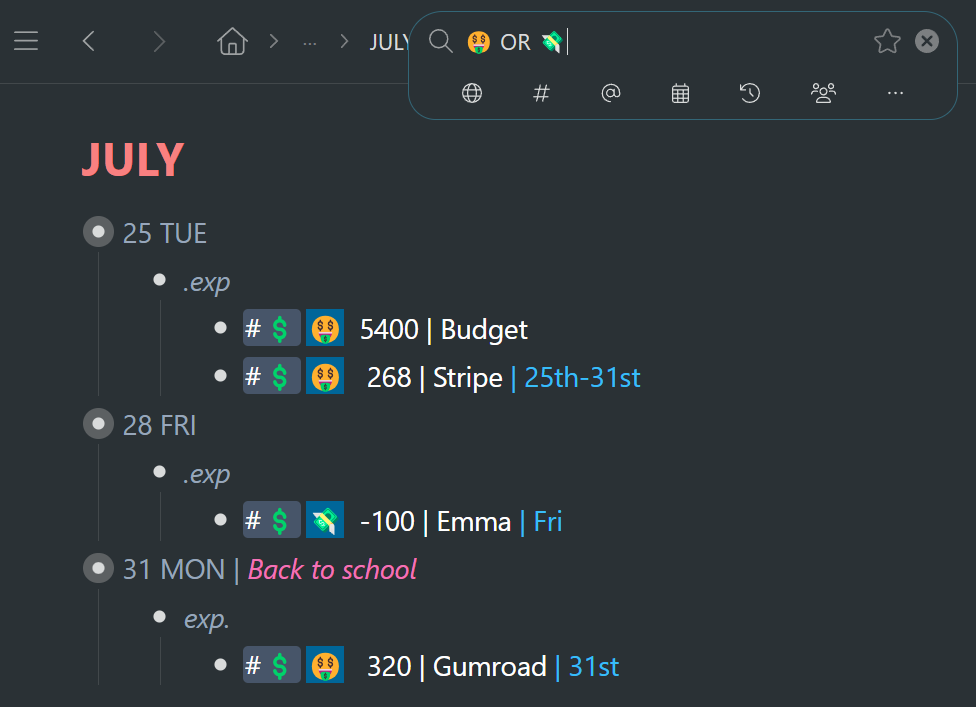

Instead of adding the "💲" tag to all budgetary items and filtering for those…

I could simply filter for "🤑 OR 💸" in the search box:

It will give the same results. The difference would be having one less tag category. I'll have to think about it. I'm a big fan of anything that cuts down on admin and visual clutter.

Reminders →Workflowy is a minimalist note taking app that helps you organize your life. Simple enough to hold your grocery list, powerful enough to hold your entire life.